37+ pay off mortgage with 401k cares act

New law provides relief for eligible taxpayers who need funds from IRAs and other retirement plans. Save Thousands Each Year.

I Am 65 And Going To Retire Next Year The Only Debt I Have Is 55k On My House Should I Take Out The Money Out Of My 401k Which Has A

Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

. Web What The CARES Act 401K Withdrawal Affects. But this increase isnt automatic. So far relatively few Americans have.

Save Real Money Today. Web If youre younger than 59½ youre ordinarily subject to a 10 percent early withdrawal penalty in addition to income tax if you remove money from an IRA 401k or. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage.

Web The CARES Act allows you to withdraw up to 100000 from your retirement account -- penalty-free -- until the end of 2020. In the past you have been allowed to borrow up to 50 of your account balance or 50000 whichever is less. Web For example the act eased limits on early distributions from tax-advantaged retirement accounts and also increasing the amount people could borrow from their.

Web The CARES Act has made it easier for workers suffering due to the Covid-19 pandemic to tap their 401 k plans and IRAs. It also relaxes rules on taking out a. He also pointed out that if youre paying say 25 on your mortgage and you pay it off you essentially just earned that.

Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals. Web Under the CARES Act early 401k withdrawal penalties are eliminated for qualified individuals making withdrawals up to 100000 for coronavirus related distributions. Web If you do qualify to take advantage of CARES Act retirement plan benefits paying off your mortgage with those funds would help save you money over time.

Web The CARES Act gives you an extra year to pay off your loan for a total of six years if you take out a loan in 2020. Web Heres a look at more retirement news. Web If you do qualify to take advantage of CARES Act retirement plan benefits paying off your mortgage with those funds would help save you money over time.

Web In addition the CARES Act provides that plans may implement certain relaxed rules for qualified individuals relating to plan loan amounts and repayment terms. US Mortgage Relief Program. Web The new CARES Act increases the potential size of loans from 401 k-style plans to a maximum of 100000 from 50000 before.

Web The CARES Act is making changes there too. The CARES act affects retirement accounts such as 401 k accounts by lifting penalties for early withdrawal. Ad Homeowners Get Generous Mortgage Relief Benefit.

The plan has 50 participants with plan assets that exceed 500000 but are less than ten million dollars. Web The new provisions from the CARES Act allow Americans to draw down money from tax-deferred accounts without penalties. Web AZ Corp 401k Plan maintains a participant loan program.

Ad Increasing Mortgage Payments Could Help You Save on Interest. IR-2020-172 July 29 2020. WASHINGTON The Internal.

The legislation also extends the repayment deadline. Check Eligibility In 60 Seconds. An individual can now take a withdrawal of.

Should I Use My 401 K To Pay Off My Mortgage 5 Things To Consider Principal Com

Pulled Money From A 401 K Plan For An Emergency What It Means For Your Taxes

How To Pay Off A 401k Loan Early The Budget Diet

Does Using Your 401k To Pay Off Debt Make Sense

What S Up West County March 2021 By What S Up Media Issuu

Leesburg Today June 19 2014 By Insidenova Issuu

401 K Hardship Withdrawals And Loans Are Different We Answer Your Questions About The Cares Act Barron S

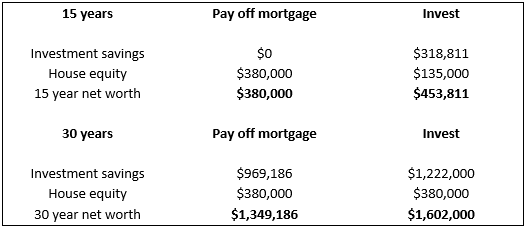

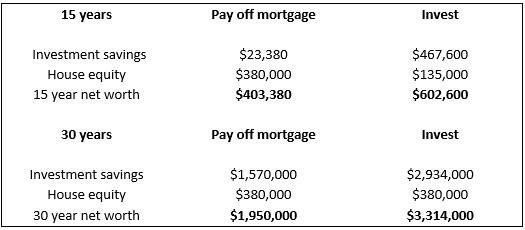

Deciding The Pay Down Mortgage Or Invest Debate Esi Money

Can A Foreign Company In U S A Avoid Paying Taxes At All Quora

Dave Ramsey S Early Mortgage Pay Off Advice Good Idea

Should You Pay Your Mortgage Off Early Calculator Included Young Dumb And Not Broke

Should You Pay Off Your Mortgage Before You Retire Credible

Deciding The Pay Down Mortgage Or Invest Debate Esi Money

How To Get A 401 K Loan Forbes Advisor

Should You Pay Off Your Home With Retirement Funds Pros And Cons

2468 Process Innovation Enterprise Architecture Foundation For O

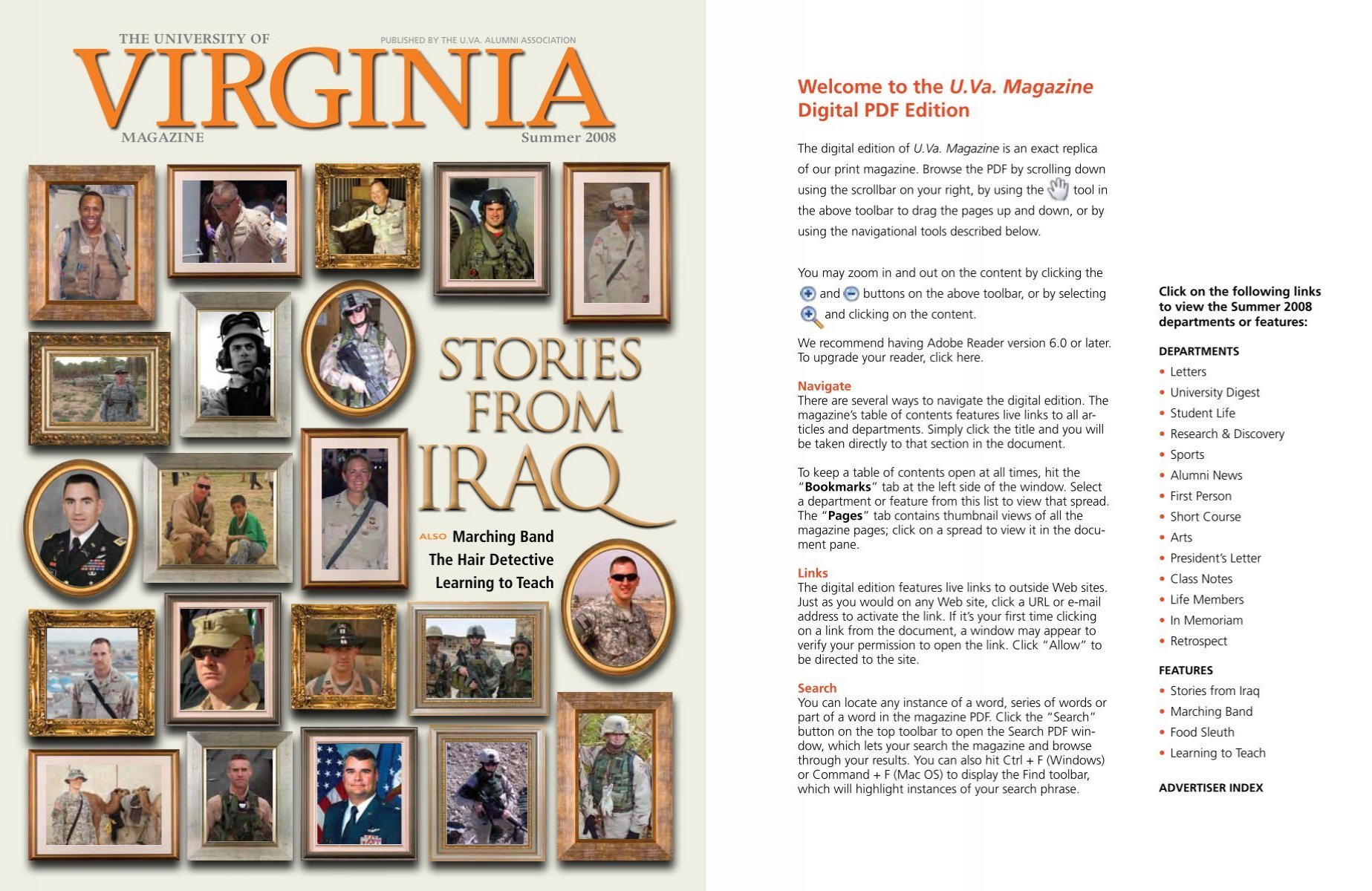

Stories From Stories From U Va Alumni Association University Of